Smart Coverage. Real Savings.

We know you’ve got enough on your plate, let us handle the insurance side. At Abdi Insurance, we find policies that fit your needs and your budget. No fluff, no confusion, just honest guidance and coverage that protects what matters.

Smart Coverage. Real Savings.

We know you’ve got enough on your plate, let us handle the insurance side. At Abdi Insurance, we find policies that fit your needs and your budget. No fluff, no confusion, just honest guidance and coverage that protects what matters.

Our Trusted Partners

Our Trusted Partners

About Us

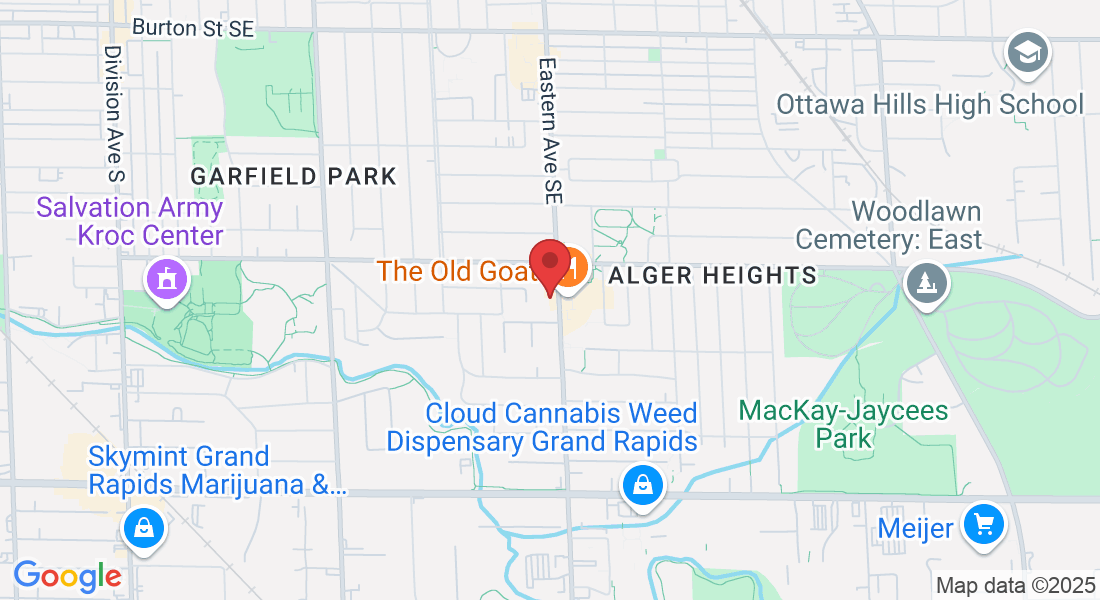

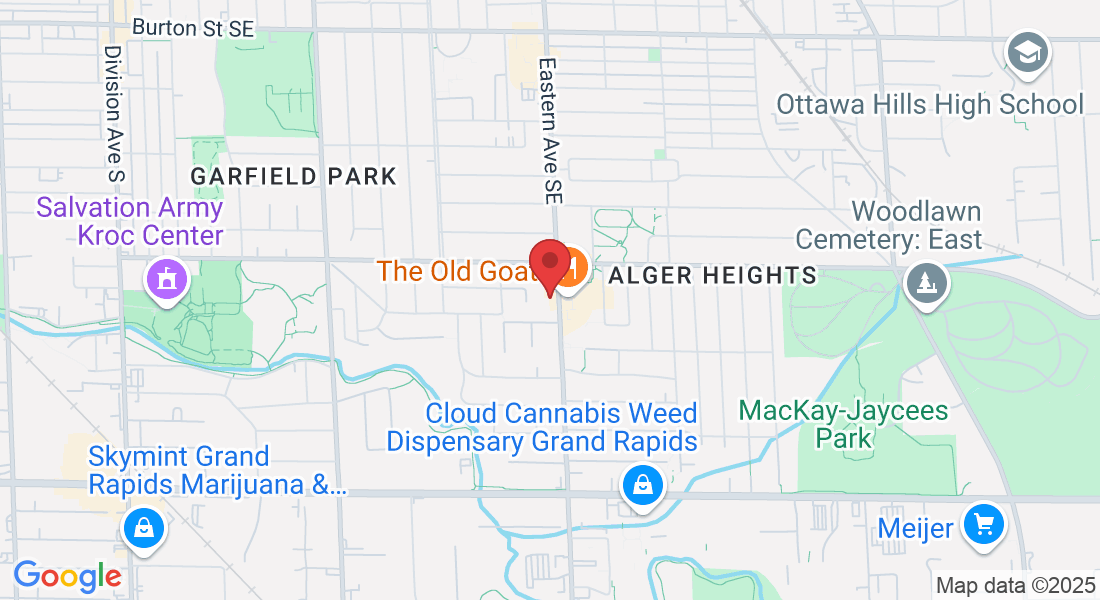

At Abdi Insurance, we’re more than brokers, we’re your allies in protection. We keep things simple, honest, and personal. We’re here to help you protect the things that matter most, whether that’s your business, your home, or the car you drive every day.

From our office in Grand Rapids, we work with individuals, families, and businesses all across Michigan. We take the time to listen, explain your options, and help you feel confident about your coverage.

We started this agency with one goal in mind: to be the kind of insurance partner people can actually count on. That’s still what drives us every day.

About Us

At Abdi Insurance, we’re more than brokers, we’re your allies in protection. We keep things simple, honest, and personal. We’re here to help you protect the things that matter most, whether that’s your business, your home, or the car you drive every day.

From our office in Grand Rapids, we work with individuals, families, and businesses all across Michigan. We take the time to listen, explain your options, and help you feel confident about your coverage.

We started this agency with one goal in mind: to be the kind of insurance partner people can actually count on. That’s still what drives us every day.

WHAT WE OFFER

Explore our Services

Tailored Commercial Insurance Solutions

No two businesses are the same—and your insurance shouldn’t be, either. We take the time to understand your industry, operations, and risks, then build a coverage plan that actually fits. Whether you’re a contractor, restaurant, or professional service, we match you with policies that protect what matters most without breaking your budget.

Risk Assessment and Management

Insurance is just one part of protecting your business—we help you go further. Our team works directly with you to spot gaps, reduce risks, and improve safety protocols. Better planning means fewer surprises, smoother operations, and potential savings on your premiums over time.

Claims Advocacy and Support

If something goes wrong, we don’t leave you hanging. We’ll help you through the claims process from start to finish—filing, following up, and fighting for what’s fair. You won’t be stuck on hold with a call center—we’re here to help keep your business moving forward, even after a setback.

Insurance Program Reviews

Don’t just take our word for it—see what others are saying! Clients count on us for honest advice and smart coverage.

Check out our reviews below.

WHAT WE OFFER

Explore our Services

Tailored Commercial Insurance Solutions

No two businesses are the same—and your insurance shouldn’t be, either. We take the time to understand your industry, operations, and risks, then build a coverage plan that actually fits. Whether you’re a contractor, restaurant, or professional service, we match you with policies that protect what matters most without breaking your budget.

Risk Assessment and Management

Insurance is just one part of protecting your business—we help you go further. Our team works directly with you to spot gaps, reduce risks, and improve safety protocols. Better planning means fewer surprises, smoother operations, and potential savings on your premiums over time.

Claims Advocacy and Support

If something goes wrong, we don’t leave you hanging. We’ll help you through the claims process from start to finish—filing, following up, and fighting for what’s fair. You won’t be stuck on hold with a call center—we’re here to help keep your business moving forward, even after a setback.

Insurance Program Reviews

Don’t just take our word for it—see what others are saying! Clients count on us for honest advice and smart coverage.

Check out our reviews below.

FAQs

What types of businesses do you specialize in insuring?

At [Your Company Name], we pride ourselves on our versatility. We have experience insuring a wide range of businesses across various industries. Whether you run a small family-owned restaurant, a tech startup, or a large manufacturing facility, we have the expertise to tailor insurance solutions to your specific needs. Our goal is to provide coverage that fits your unique industry and business requirements.

How can I reduce my insurance premiums without compromising coverage?

We understand that controlling costs is essential for any business. Our team is dedicated to finding cost-effective solutions without sacrificing coverage quality. We achieve this by conducting regular policy reviews, exploring discounts, and leveraging our network of insurance providers to secure competitive rates. Additionally, our proactive risk management strategies can help you reduce claims, which can lead to lower premiums over time.

What should I do in the event of a claim?

If you need to file a claim, we're here to guide you through the process. Please contact our claims support team as soon as possible to report the incident. We'll provide you with the necessary forms and instructions to initiate your claim. Our team will work closely with you and the insurance provider to ensure a smooth and efficient claims resolution process. Your peace of mind is our priority, and we're here to assist you every step of the way.

OUR TEAM

John Doe

Jane Doe

John Doe